This week saw Uniswap experience a robust recovery as the broader cryptocurrency market experienced growth, resulting in increased activity on their platform. The UNI token value climbed significantly over the past three days, hitting its peak since March 28. This represents an increase of nearly 50% from its yearly low, which now values it at more than $4.2 billion in terms of market capitalization.

Uniswap’s price surges as trading volume spikes

As investors returned to the market, the volume of assets flowing into centralized and decentralized exchanges jumped this week. This surge happened as Bitcoin soared to over $104,000 for the first time in months, and as Bitcoin crossed the important $2,000 barrier.

The leading decentralized exchange Uniswap saw significant trading activity, with its 24-hour volume surging to $14.5 billion. Over the past month, it has facilitated transactions totaling more than $52 billion, far exceeding PancakeSwap’s processed value of approximately $35.6 billion during the same period.

This volume will likely grow if the crypto market bull run continues as many top analysts expect. For example, our

Bitcoin price prediction

projected to continue rising this year and might reach the resistance level at $150,000.

Other analysts from companies like Standard Chartered and Ark Invest expect the surge to continue and hit over $200,000 in the next few months. A Bitcoin price surge would benefit other altcoins since they often follow the footsteps of BTC.

This expansion will persist, positioning Uniswap as one of the highest-grossing platforms in the cryptocurrency sector. This year alone, it has generated more than $336 million, outperforming other well-known entities such as Ethereum, AAVE, and PancakeSwap within the crypto space.

Unichain gowth continues

The price of Uniswap has also surged due to ongoing developments.

growth of Unichain

It’s a Layer 2 network that was introduced several months back.

Unichain is a platform designed to offer developers an improved blockchain solution for their decentralized finance projects. It stands out due to its rapid transaction processing, facilitated by blocks that take only one second to confirm, along with the capability of facilitating cross-chain transactions.

Unichain likewise emphasizes its community, as 65% of total earnings are redirected to the community members.

This attraction has drawn numerous developers such as Stargate Finance, Venus, Compound Finance, Velodrome, and DyorSwap. Consequently, the total value locked (TVL) within this ecosystem surged above $753 million, with stablecoin holdings rocketing up to $317 million overall.

In contrast, Cardano, a chain that has been around for years, has only $30 million in stablecoins.

Unichain is also becoming a more popular player in the DEX industry, handling over

$606 million

in daily volume. Its transactions rose by 67% in the last seven days to $2.82 billion, bringing the cumulative total to $7 billion.

Unichain has flipped some of the top players in the crypto industry like Sui, Avalanche, and Tron.

UNI price analysis

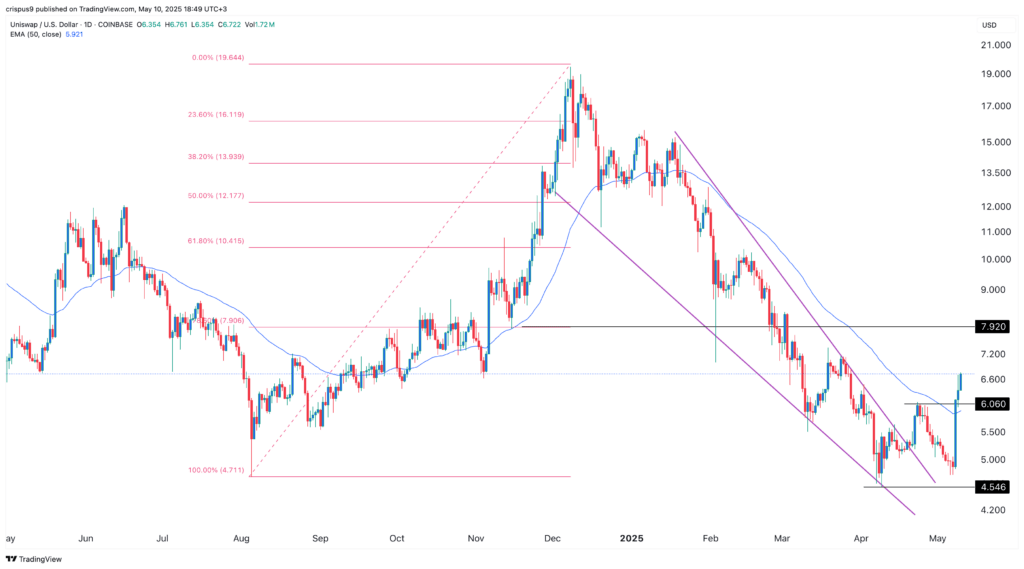

The daily chart indicates that the UNI price mirrors that of numerous other altcoins. It has created a large descending wedge configuration, which is commonly seen as a bullish reversal signal. Recently, the cryptocurrency established a double-bottom formation around $4,545, with its neckline positioned at approximately $6,060. This type of pattern typically precedes a bullish turnaround.

The Uniswap price has breached the neckline and risen above the 50-day Exponential Moving Average. Leading momentum indicators such as the Relative Strength Index (RSI) and the MACD have kept climbing this week.

Hence, the probable Uniswap price prediction leans towards an upward trend. The key level to monitor next would be at $7.92, representing the 78.2% retracement level, situated approximately 18% higher than where it stands now. If the price falls beneath the support of $6, this bullish perspective would become invalid and could suggest a decline down to around $4.55.

The post

Uniswap price forecast: UniChain actions boost UNI’s upward trajectory

appeared first on