On April 29, UK Treasury Minister Rachel Reeves presented plans for a “holistic regulatory framework” designed to position the nation as a world leader in digital currencies.

Under

the proposed rules

Crypto exchanges, dealers, and agents will face regulation akin to conventional financial institutions in the UK, necessitating standards for transparency, consumer protection, and robust operations, as stated by the UK Treasury.

said

Following Reeves’ comments, a statement was issued.

As stated, the Financial Services and Markets Act 2000 (Cryptoassets) Order 2025 establishes six new regulated activities such as cryptocurrency trading, custodianship, and staking.

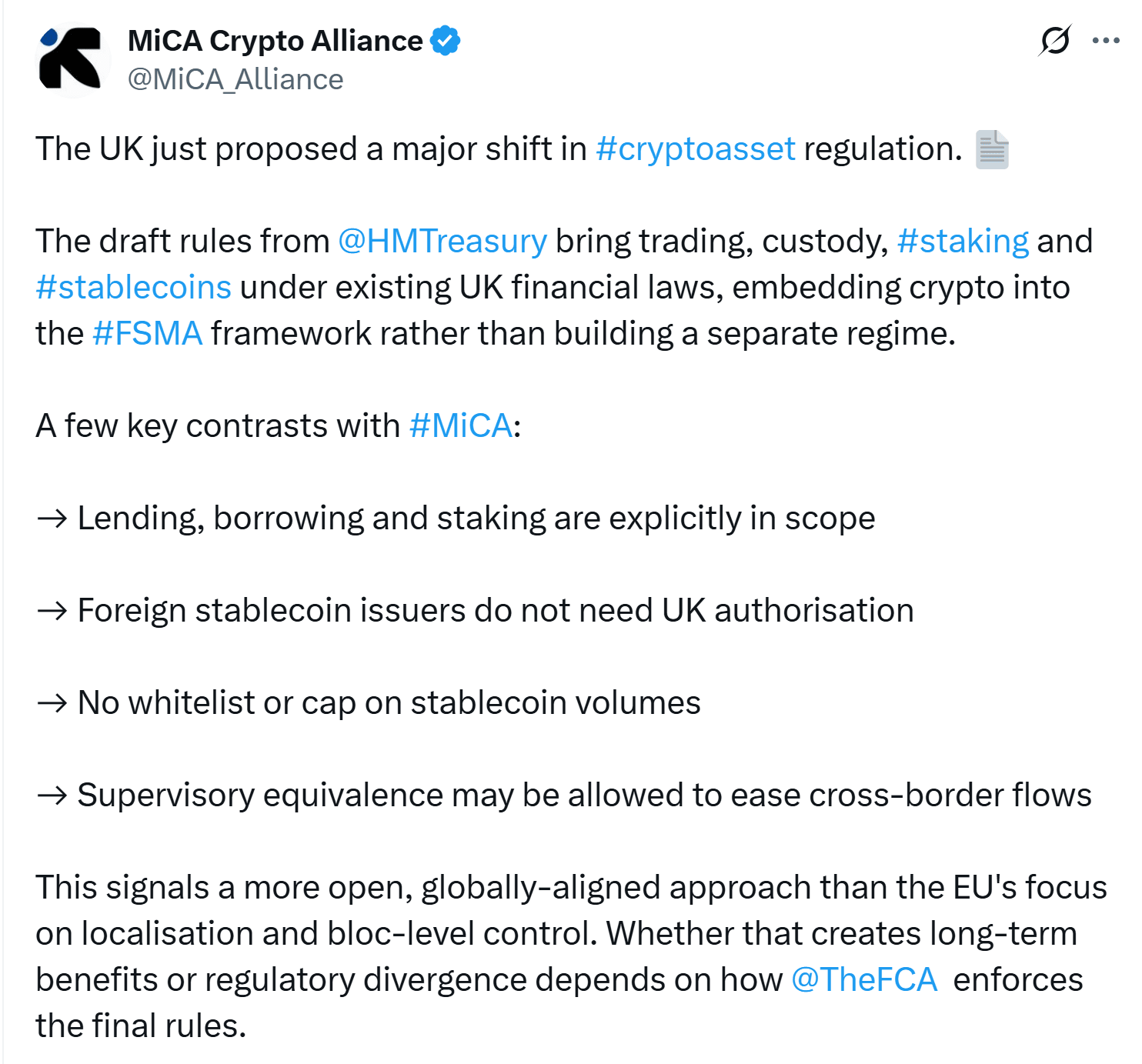

Instead of choosing a lightly regulated approach like the one used by the European Union,

Markets in Crypto-Assets (MiCA)

, the UK is enforcing comprehensive securities regulations on cryptocurrency.

according

To the UK-based law firm Wiggin. This encompasses capital requirements, governance standards, market abuse regulations, and disclosure obligations.

“The proposed cryptocurrency regulations in the UK signify a significant move towards establishing a regulated digital asset ecosystem,” said Dante Disparte, chief strategy officer and head of global policy at Circle, according to Cointelegraph.

Through indicating readiness to offer clearer regulations, the UK is establishing itself as a sanctuary for ethical advancement.

Disparate noted that the suggested framework could offer the necessary predictability for “expanding responsible digital financial infrastructure in the UK.”

Related:

Revolut doubles profits to $1.3B on user growth, crypto trading boom

The UK’s latest cryptocurrency regulations are considered “overall beneficial.”

Vugar Usi Zade, who serves as the chief operating officer (COO) at Bitget exchange, likewise conveyed his positivity about the fresh regulatory measures, stating that they “are ultimately beneficial” for the sector.

I believe many businesses have either withdrawn from or been hesitant to join the UK market due to uncertainty regarding which activities, products, and operations require FCA approval. Companies now have precise descriptions of ‘ qualifyingcryptoassets’ and can clearly identify whether their trading, custodial, staking, or lending services necessitate obtaining FCAauthorization.

Regarding exchanges like Bitget, the proposed regulations in the UK indicate that they must obtain complete authorization from the Financial Conduct Authority (FCA) to provide cryptocurrency trading, custodial services, staking, or lending to users within the UK.

The regulations provide businesses with a two-year timeframe to modify their systems, including capital structures and reporting mechanisms. “Assigning each service line to the updated boundary increases compliance costs; however, this clear delineation enables us to strategize our product launches and allocate resources towards local infrastructure,” stated Zade.

The updated draft regulations now categorize stablecoins as securities rather than electronic money. As a result, UK-based fiat-backed tokens will be required to comply with disclosure requirements similar to those for investment prospects and follow specific redemption procedures. However, non-UK stablecoins may continue to operate within the country, albeit exclusively through approved platforms.

Zade argued that leaving stablecoins outside the Electronic Money Regulations 2011 (EMRs) and consequently keeping them away from the e-money sandbox might hinder their adoption for payments.

However, Disparte, whose company issues USDC,

USDC

The world’s second-biggest stablecoin by market cap stated that predictability is crucial for promoting responsible development in the UK.

What truly counts is consistency: a structure that allows companies to develop, evaluate, and expand responsibly—free from concerns about unpredictable enforcement or changing regulations. Should this come to fruition, it might represent a crucial turning point in the UK’s progression with digital assets.

Related:

UK watchdog seeks to limit loans for cryptocurrency purchases

UK will mandate FCA approval for overseas crypto companies

One of the most significant alterations within the updated draft regulations pertains to their geographical scope. Platforms based outside the UK but catering to British retail customers must now obtain authorization from the Financial Conduct Authority. The “overseas persons” exception has been narrowed down exclusively for particular business-to-business interactions, thereby safeguarding the UK retail sector.

Cryptocurrency staking has also come under new regulations. Services offering liquid and delegated staking must now register, whereas solo stakers and those providing solely through interfaces are excluded from this requirement. Additionally, updated custody guidelines apply to setups where one entity holds unilateral transfer capabilities, which includes specific types of lending activities and multiparty computation configurations.

“Some aspects of DeFi still require clarification, but the trend is moving towards effective, customized compliance instead of outright prohibition,” according to Zade from Bitget.

He mentioned that the wide-ranging “staking” definition could potentially include non-custodial DeFi models without a centralized service provider. He also noted that the proposed limitations on credit card purchases, intended for high-risk activities, might reduce everyday user involvement in token launches.

Moreover, Zade mentioned that banking-level separation regulations for customer funds might impose significant costs on the resource-constrained DeFi projects. “The final adjustments should aim to alleviate these unintended consequences.”

The FCA

set to release concluding regulations

In cryptocurrency, potentially by 2026, the foundation will be laid for the UK’s regulatory framework to become operational. The path toward enhanced regulatory transparency in the UK might mirror that of the European Union, which

started to implement

It’s the MiCA framework in December.

Magazine:

Ultimately soar into space alongside Justin Sun, Vietnam’s latest national blockchain initiative: Asia Express