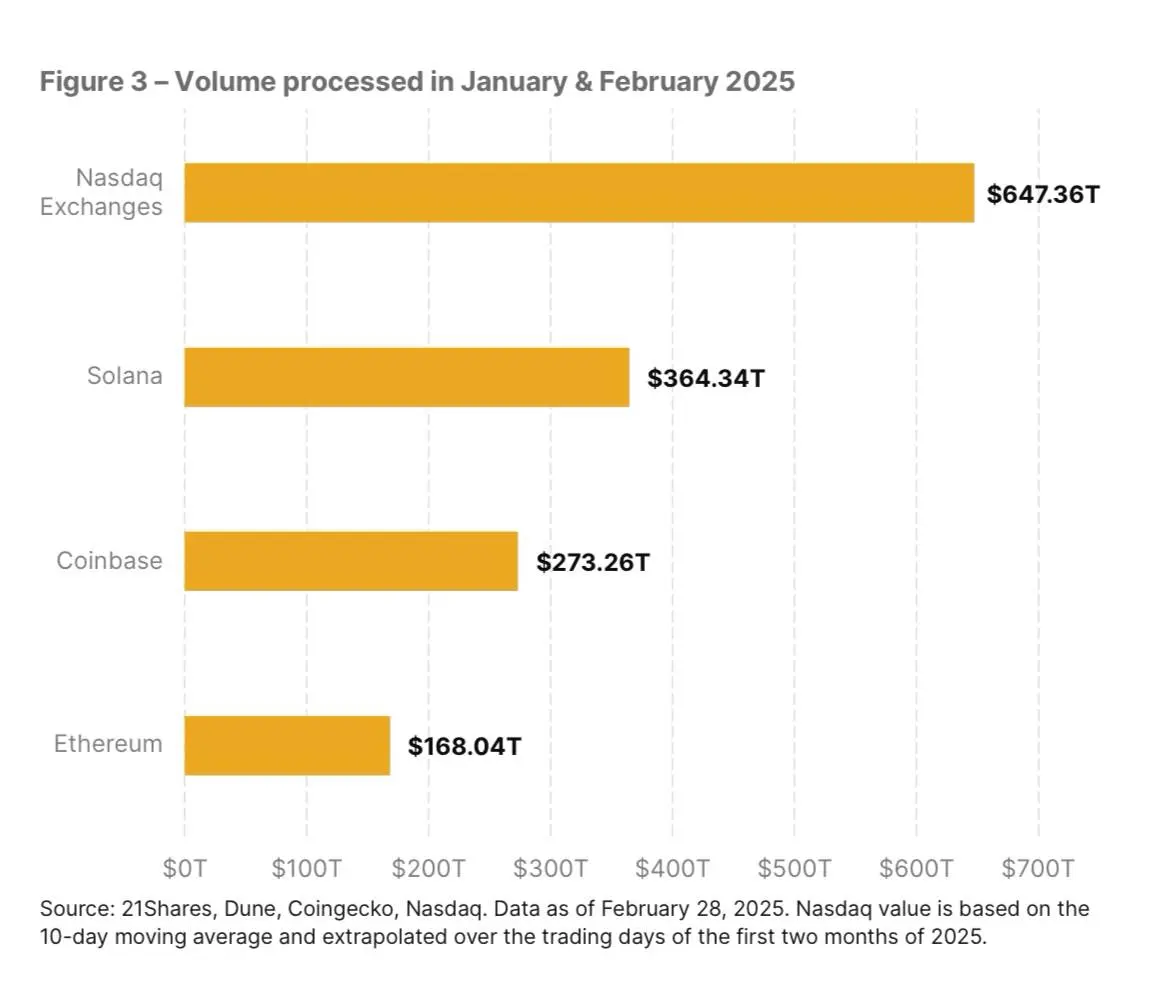

The digital asset management company 21 Shares stated that Solana could emerge as the focal point for online transactions. According to their recent State of Crypto report, Solana surpassed both Coinbase and Ethereum in terms of transaction volume during the initial two months of 2025.

According to the

report

In January and February 2025, Solana handled a transaction volume of $364.34 billion, placing it above both Coinbase and Ethereum. The only platform leading this metric was Nasdaq, which reached $647.36 billion.

This has prompted comparisons between the two, with specialists suggesting that Solana might evolve into a blockchain version of Nasdaq.

The report stated:

Currently, Solana stands as the most utilized network globally, with more than 100 million monthly active users. During its peak period in January and February 2025, Solana facilitated a trading volume exceeding $364 billion, which accounted for over half of Nasdaq’s total trade volume.

21 Shares analysts added that this performance aligns with the network growth trajectory since emerging from the ashes of FTX collapse. Since then, the network has seen a surge in almost all metrics, with capital deployed soaring more than 2,000% to almost $7 billion, while its native token SOL peaked at $263 earlier this year.

Interestingly, stablecoin activity on the network has also increased substantially, growing 600% in the last 12 months from $2.16 billion to over $12 billion.

What factors are fueling Solana’s expansion?

In the meantime, the report delved deeply into the elements propelling Solana’s growth over the last couple of years, highlighting that its infrastructure, fast transactions, and minimal fees are key contributing factors.

When compared to other networks, Solana stands out with its average block time of 0.44 seconds, which places it just behind Sui—known for its faster block time of 0.21 seconds—in the realm of prominent smart contract platforms. Additionally, this blockchain system supports as many as 65,000 transactions per second and maintains a minimal average transaction cost at merely $0.03.

Nevertheless, the expansion of the network goes further than just its infrastructure capabilities, since upcoming networks like Sui can match it in these aspects. The network’s achievements are equally due to its superior user experience and emphasis on collaborations.

The report indicated that Solana’s key partnerships with businesses play an essential role in its overall effectiveness. Collaborations with entities like PayPal, First Digital, Visa, Stripe, and Shopify ensure that millions of users depend on the network for settlement services.

It said:

Solana’s advanced technology along with its business collaborations solidifies its position as the foundation for future-generation payment solutions and widespread adoption of blockchain focused on consumers.

Moreover, the report highlighted an increase in developers working with Solana, citing an 83% expansion of its development community over the previous year. This signifies the first instance where another blockchain platform has outpaced Ethereum regarding new developer acquisition.

As developers work on Solana, the platform has witnessed an increase in novel offerings across various sectors including decentralized finance (DeFi), decentralized physical infrastructure networks (DePINs), artificial intelligence (AI), and meme coins. Notably, the report emphasized meme coins as both a key driver of growth and a significant challenge for the network’s capabilities.

What comes next for the SOL price?

In the meantime, 21Shares analysts think that SOL could potentially be underestimated, with an estimated true worth ranging from $520 to $1,800, contingent upon the growth rate. This valuation is derived using a discounted cash flow analysis.

It said:

Although grounded in Traditional Finance evaluation methods, which might not completely apply to cryptocurrency, this method highlights Solana’s inherent worth via actual revenue creation.

Based on these projections, the company thinks that the value of SOL might increase substantially, particularly as it draws greater engagement and boosts transactions on the blockchain.

Nonetheless, Solana isn’t anticipated to surpass Ethereum in terms of market capitalization anytime soon, despite how its growth might affect Ethereum’s dominance. As reported towards the end of April, SOL was being traded at approximately $152.72, with its market cap standing at roughly 34 percent of Ethereum’s value during that period.

Following this, both assets have experienced significant appreciation in value, with SOL currently valued at $182.51 and ETH having surged by 50% over the last week to reach $2,692.

Academy: Looking to increase your wealth in 2025? Discover how you can achieve this through DeFi by joining our forthcoming webclass.

Save Your Spot