Robert Kiyosaki, the entrepreneur and author of the popular book

Rich Dad Poor Dad

is once again raising concerns about the risks associated with centralized monetary policy. He is encouraging his supporters to move away from what he refers to as “fake money” and instead consider adopting alternative options such as Bitcoin, gold, and silver.

In a May 10

post

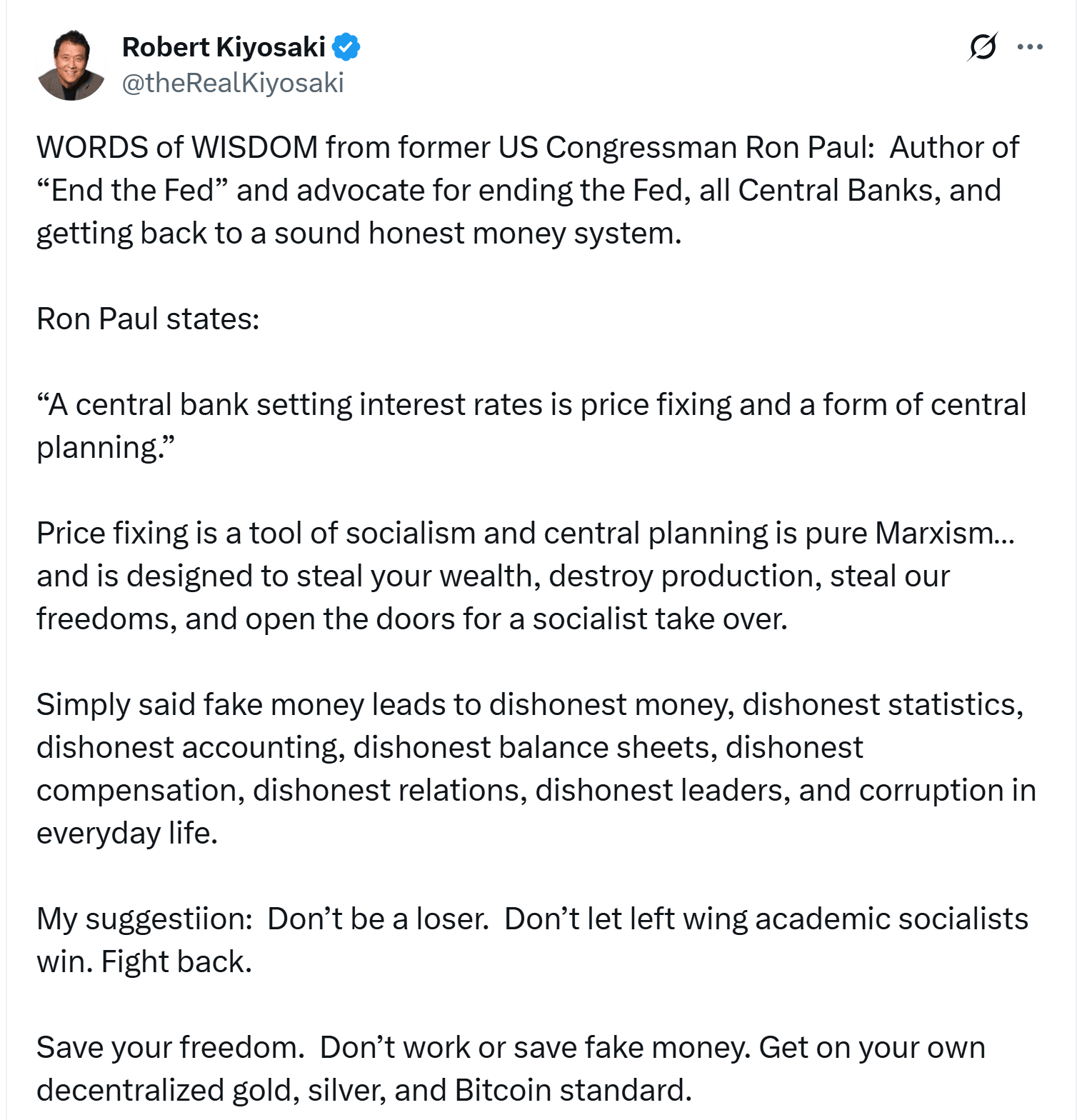

On X, Kiyosaki supported a strict position opposing central banking institutions, notably critiquing the Federal Reserve, as he cited former U.S. Representative Ron Paul.

Ron Paul, a consistent detractor of the Federal Reserve and writer of

End the Fed

, described

interest rate determinations made by central banks

As “price fixing,” likening it to socialist and Marxist economic control.

Paul warned that such mechanisms erode personal wealth and undermine economic freedom — a sentiment that aligns closely with Kiyosaki’s long-held concerns.

“Artificial funds result in deceptive finances, misleading data, fraudulent bookkeeping, tampered financial statements, unethical payoffs, false interactions, unscrupulous figures, and pervasive corruption in daily existence,” Kiyosaki penned.

He urged Americans to “push back” by withdrawing support from traditional monetary systems and adopting alternative assets such as Bitcoin, which operates independently without central authority.

BTC

) and precious metals.

Related:

‘ Rich Dad, Poor Dad’ author urges for a $1 million Bitcoin target by 2035

Kiyosaki continues to be a prominent critic of fiat currency.

Kiyosaki’s disapproval of fiat money isn’t recent. He has often condemned the U.S. dollar, deeming it a “failing” currency that has been bloated by governmental expenditures and interventions from the central bank.

His financial ideology, based on Austrian economics and individual autonomy, promotes assets that can’t be devalued or subjected to political control.

Kiyosaki has frequently contended that bearer assets such as gold, silver, and more recently Bitcoin, serve as

critical hedges against inflation

And crucial for building multigenerational wealth over time as economies cycle through different phases.

“He cautioned, ‘Avoid working for or saving counterfeit currency. Instead, establish your own decentralized system using gold, silver, and Bitcoin.’”

In a post from April 18, Kiyosaki predicted that

Bitcoin might reach $1 million.

By 2035, as the U.S. dollar keeps depreciating due to expansionary monetary strategies.

“I am convinced that by 2035, one Bitcoin will exceed $1 million, gold will reach $30,000 per ounce, and silver will go above $3,000 per coin,” he stated.

Kiyosaki isn’t alone in his optimism about Bitcoin’s prospects.

In February 2025, the CEO of ARK Investment Management, Cathie Wood, stated that

Bitcoin might reach $1.5 million

By 2030, should the demand for the digital asset continue to increase.

On December 10, Eric Trump was the keynote speaker at the Bitcoin MENA conference held in Abu Dhabi, UAE.

forecasted that Bitcoin would reach $1 million

due to its scarcity.

Magazine:

Traditional Finance enthusiasts dismissed Lyn Alden’s Bitcoin advice — Now she claims it will reach seven-figure territory: X Hall of Flame