Coinbase reportedly considered adopting a Bitcoin investment playbook like Michael Saylor’s Strategy on multiple occasions, but decided against it each time out of fear that it would kill the firm’s crypto exchange, Bloomberg reported.

“There were definitely moments over the last 12 years where we thought, man, should we put 80% of our balance sheet into crypto — into Bitcoin specifically,” Coinbase CEO Brian Armstrong

told

Bloomberg in a May 9 video call.

Armstrong said the Bitcoin (

BTC

This approach might have endangered the company’s financial standing and possibly shut down the cryptocurrency exchange. “We deliberately decided how much risk we were willing to take,” he further stated.

Alesia Haas, Coinbase’s Chief Financial Officer, who was also present during the video conference, mentioned that the company aimed not to be perceived as being in direct competition with its clients regarding which cryptocurrencies would perform better.

“Be assured, we won’t stop here,” Haas stated, following Coinbase’s announcement of acquiring another company.

$153 million worth

In its first-quarter results announcement on May 8, the focus was predominantly on cryptocurrency assets, withBitcoin being the main concentration.

According to

BitcoinTreasuries.net

Coinbase has 9,480 Bitcoins, currently valued at approximately $988 million based on today’s market price. This constitutes most of their total crypto assets totaling $1.3 billion.

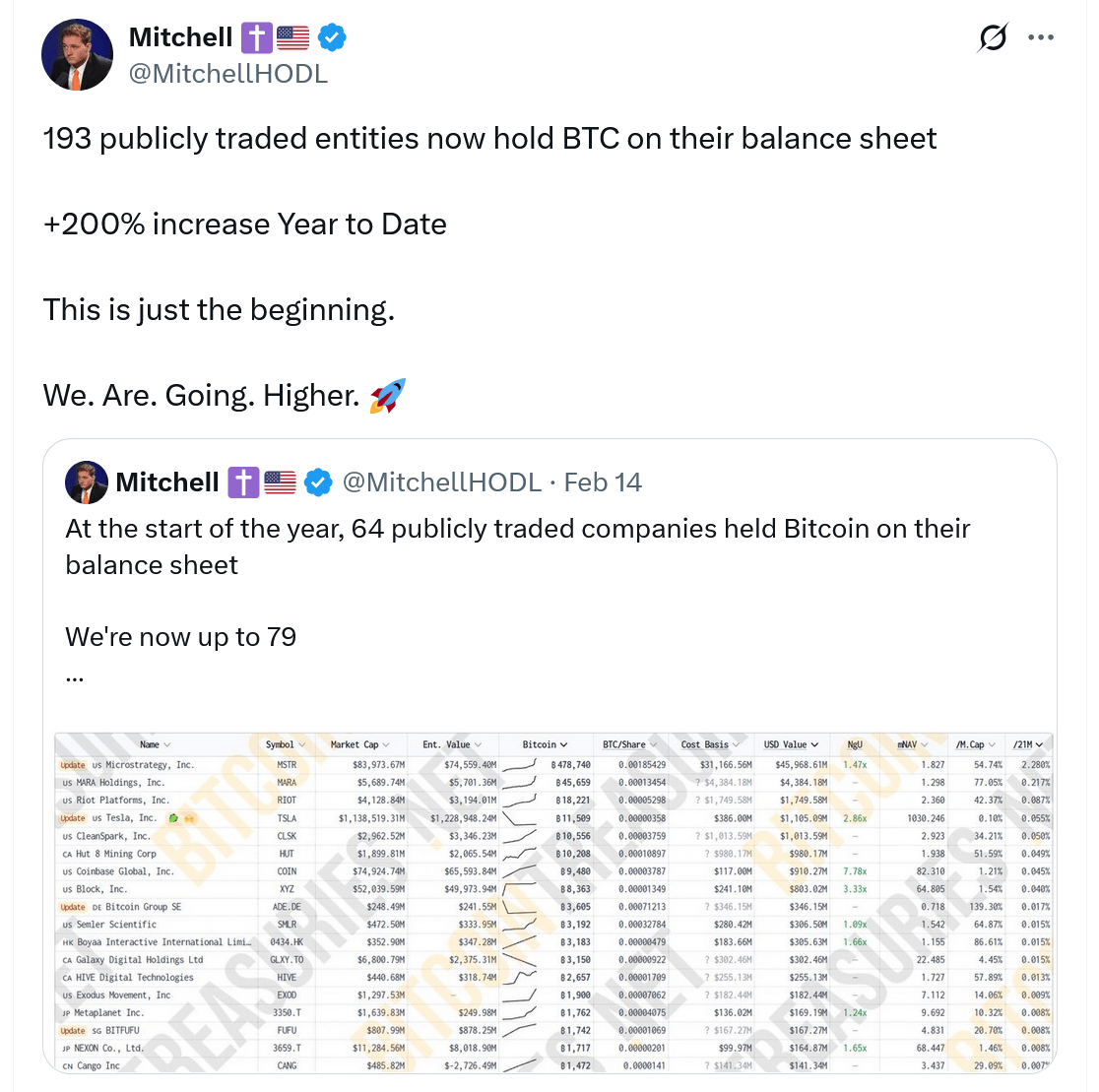

Armstrong’s cryptocurrency exchange ranks as the ninth-biggest corporate holder of Bitcoin, coming after entities such as

Strategy,

Bitcoin miner MARA Holdings along with Tesla.

Related:

$45 million taken from Coinbase users in just one week—ZachXBT

Many businesses have started adopting Saylor’s approach to Bitcoin, financing acquisitions via stock and debt offerings, relying on the expectation that an increase in Bitcoin’s value will enhance their equity valuations.

More than 100 publicly traded companies worldwide have disclosed owning Bitcoin, along with an additional 40 entities issuing exchange-traded funds, 26 privately held firms, and 12 national governments that have also announced their holdings of the digital currency.

Coinbase strengthens its derivatives portfolio via acquiring Deribit.

On May 8, Coinbase

agreed to acquire

crypto derivatives platform Deribit for $2.9 billion, making it the biggest corporate acquisition in the sector so far.

This purchase will extend Coinbase’s presence in the market.

crypto derivatives market

greatly, which was formerly restricted to its Bermuda-based platform.

Coinbase observed that Deribat handled more than $1 trillion in transactions.

trading volume

In 2024 and holds approximately $30 billion in current open interest.

The company stated that this agreement positions Coinbase as the “global frontrunner” in cryptocurrency derivative trades.

Magazine:

Crypto aimed to dismantle traditional banking systems, but now they find themselves competing with these institutions in the stablecoin battle.