A few years back, when artificial intelligence (AI) started gaining prominence, most discussions centered on its potential use in business settings to boost productivity, data analysis, and efficiency. Although AI indeed supports these areas, its capabilities extend well beyond them.

Certain nuanced applications of artificial intelligence encompass process optimizations in pharmaceutical research, financial deception detection, and cyber security. However, significant advancements in these fields will require upgrades to current AI methodologies.

Where should you put your $1,000 investment at this moment?

Our analysis group has just disclosed their thoughts on what they consider to be the top choices.

10 best stocks

to buy right now.

Learn More »

This is where

quantum computing

becomes relevant. Although quantum computing isn’t currently a commonly used element within AI, the potential it offers is immense.

Let’s delve into the world of quantum computing and identify which firms are causing ripples in this field. Crucially, following an extensive examination of leading contenders within the sector, I will unveil my choice for the most disruptive force in quantum computing today. Additionally, I’ll present compelling reasons as to why savvy investors ought to seize this opportunity without delay.

1. The potential of quantum computing represents a huge opportunity

The management consultancy McKinsey & Company estimates that the

total addressable market (TAM)

Quantum computing has the potential to generate up to $131 billion by 2040. According to McKinsey, key sectors such as transportation, life sciences, chemicals, and finance stand to benefit significantly—possibly accumulating $1.3 trillion in value by the middle of the coming decade due to the uptake of quantum computing technologies.

2. This artificial intelligence stock represents an underappreciated chance in the field of quantum computing.

Interest in quantum computing began to grow towards the end of 2024. During this time, lesser-known figures like

IonQ

,

D-Wave Quantum

,

Quantum Computing

, and

Rigetti Computing

started observing unusual purchasing behavior. Such occurrences aren’t rare. Frequently, as a new trend starts to pick up speed, lesser-known participants often begin experiencing some traction — typically fueled by speculation or popular narrative trends.

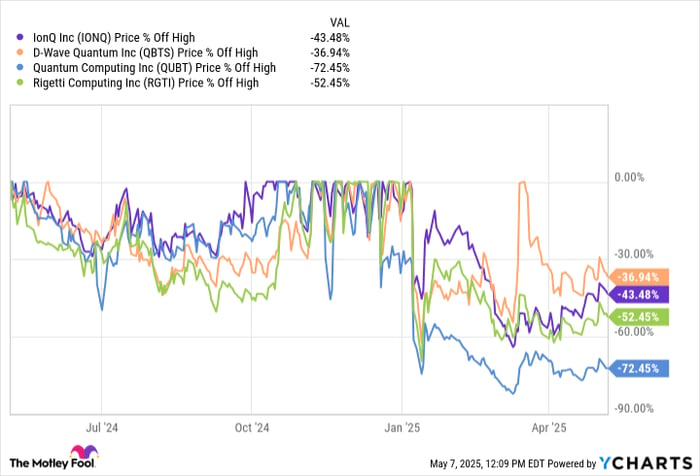

As indicated in the chart above, every quantum computing stock I discussed previously is currently trading significantly below its previous peaks. Although this could imply that these formerly popular stocks may be attractive purchases at present, we should examine their valuations further.

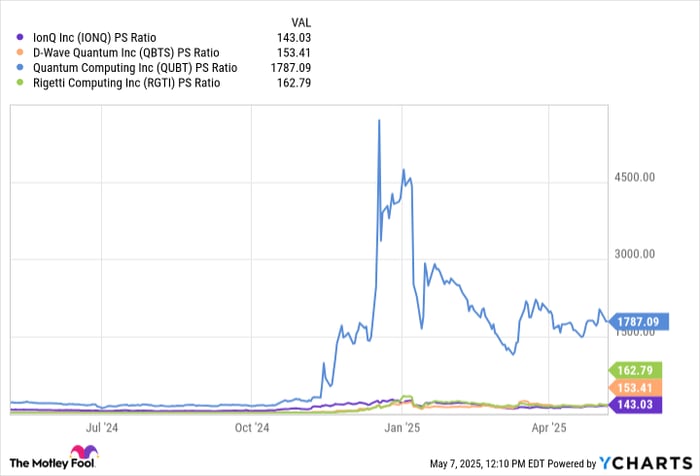

Despite their precipitous sell-offs, each of the stocks in this peer set still trades for extended valuations. The magnitude of these

price-to-sales (P/S)

Multiple underscores indicate that IonQ, Rigetti Computing, Quantum Computing, and D-Wave Quantum are not producing significant revenues as of now—nevertheless, each firm is valued at nearly or over $1 billion.

Furthermore, all these firms lack a clear track record for achieving steady profits. Considering these valuation factors, none of the quantum computing stocks in this group are being traded at prices indicating optimism.

buying the dip

.

Beyond the smaller players, several “Magnificent Seven” stocks, including

Amazon

,

Alphabet

, and

Microsoft

, are also stealthily competing in the quantum computing realm. Despite their individual efforts, each of these firms

made significant strides in quantum computing

, my current favorite in this area at the moment is

Nvidia

(NASDAQ: NVDA)

.

At the moment, Nvidia is best known for its AI chips, called graphics processing units (GPUs). However, few investors understand that Nvidia also has a software product called CUDA that works in parallel with the GPUs. By tightly integrating both its hardware products with an in-house software service, Nvidia is quickly building an end-to-end platform for enterprise AI infrastructure.

NVIDIA is extending this approach by weaving an additional thread into the larger CUDA tapestry.

CUDA-Q

Nvidia currently offers a software package designed to complement the necessary hardware for advanced quantum computing operations. Similar to how they have dominated the AI chip sector, I believe the company will also make significant strides in the field of quantum computing, even though it hasn’t garnered much attention yet in this area.

3. Nvidia’s stock seems like a good deal right now.

Like the other stocks discussed in this article, Nvidia’s shares are also significantly below their peak values. As of today’s date (May 7), the price of Nvidia stock has dropped by 24% from its highest point over the past year.

shedding almost $1 trillion from their market capitalization

in the process.

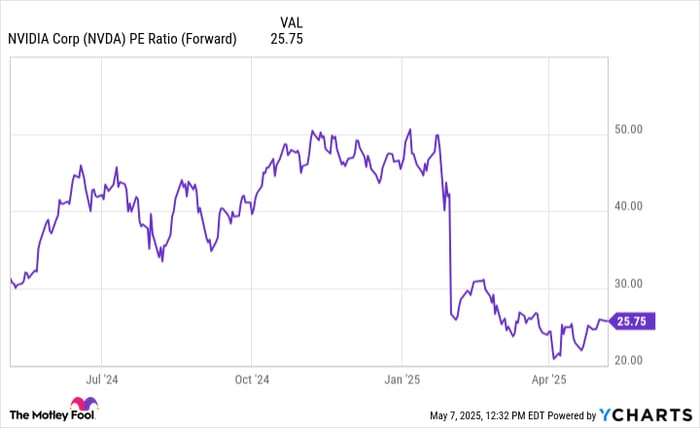

However, distinct from IonQ, Rigetti, D-Wave Quantum, and Quantum Computing, Nvidia’s stock boasts a more moderate valuation. As shown beneath, the company’s valuation appears compressed.

projected price-to-earnings (P/E) ratio

Several indications might imply that perceptions of Nvidia have either become more balanced or that investors focused on growth may be losing interest in the stock.

Despite some near-term uncertainty as it pertains to the ongoing tariff situation and Nvidia’s prospects in China, I would not write off the company. For now, Nvidia remains in control of the AI chip market, and as explored above, quantum computing represents a longer-term opportunity worth tens of billions of dollars for the company.

I think investors with a long-term horizon should consider taking advantage of Nvidia’s current depressed price action and buy the stock hand over fist.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

From time to time, our skilled group of analysts releases a

“Double Down” stock

Here’s a suggestion for firms that seem poised for growth. Should you fear missing out on potential gains, this could still be an opportune moment to purchase shares prior to their inevitable rise. The data clearly supports this outlook:

-

Nvidia:

If you had put in $1,000 when we increased our investment in 2009,

you’d have $302,503

!* -

Apple:

If you had invested $1,000 when we increased our investment in 2008,

you’d have $37,640

!* -

Netflix:

If you had invested $1,000 when we increased our stake back in 2004,

you’d have $614,911

!*

Currently, we’re sending out “Double Down” alerts for three amazing companies.

available when you join

Stock Advisor

,

And this might not come around again for quite some time.

*Stock Advisor returns as of May 5, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors.

Adam Spatacco

has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a

disclosure policy

.