This week, Bitcoin succeeded in regaining the $100,000 mark for the first time since February due to easing economic tensions in the U.S.

The larger cryptocurrency market followed suit, with the overall market capitalization increasing by more than 8% to around $3.37 trillion by Friday.

The sentiment indicators mirrored the upswing, with the Crypto Fear and Greed Index rising from 67 to 73, solidifying its place in the “greed” territory.

Strength was more pronounced in the altcoin markets, where the majority of the top 99 finished the week showing positive returns, with numerous coins achieving double-digit increases.

What factors are causing Bitcoin’s value to increase?

By the end of the Asian trading session on Friday, Bitcoin had risen more than 6% for the week, with many leading cryptocurrencies also experiencing significant gains.

A late-week rally occurred after news broke about resuming U.S.-China trade discussions along with escalating geopolitical strains between India and Pakistan. These factors introduced new fluctuations into worldwide risk markets.

US Treasury Secretary Scott Bessent affirmed his intention to convene with China’s Ministry of Commerce in Switzerland for talks about trade obstacles.

The declaration garnered a positive reaction from Beijing, boosting confidence in risk markets and aiding in uplifting the mood within the cryptocurrency community.

In addition to the optimistic atmosphere, a fresh factor has emerged.

US-UK trade dea

I announced on May 8 that optimism had increased even more.

In the meantime, the Federal Reserve kept interest rates unchanged, with Fed Chairman Jerome Powell cautioning that the risk of high inflation persists.

Nevertheless, the lack of unforeseen tightening provided traders with some comfort, as there were no rate reductions, nor any unpleasant surprises.

This clarity, along with a return of risk tolerance and new institutional investments, contributed to pushing Bitcoin’s value up.

The continuation of this trend was largely driven by institutional involvement. According to data provided by Farside Investors, spot Bitcoin ETFs saw total net inflows amounting to $142.3 million on just one day—May 7.

On May 8, inflows continued to be robust, with Bitcoin ETFs drawing an additional $117 million, primarily driven by BlackRock’s IBIT which garnered $69 million.

Bitcoin price outlook

As Bitcoin appeared to stabilize above the $100k level, experts began establishing lofty goals for the leading digital currency.

While writing, Bitcoin was approximately 5% beneath its peak value of nearly $109K reached towards the end of January this year; however, numerous experts thought that setting a new record high could be imminent.

In the near term, traders like AlphaBTC are eyeing a move toward $106,000.

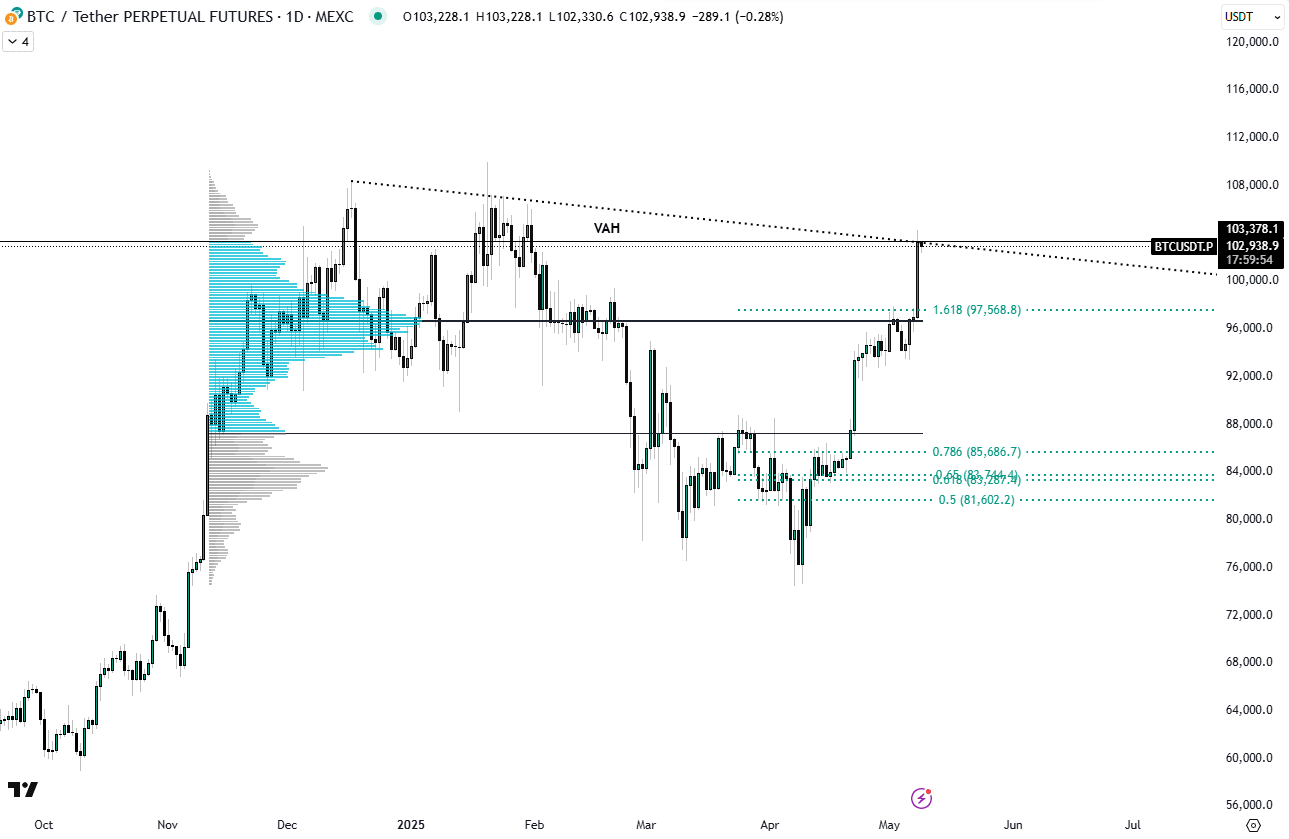

He indicated how Bitcoin broke out of an ascending parallel channel, noting that the Fibonacci retracement levels aligned perfectly with key support areas.

“It leads me to believe that BTC still has room to reach above 106K before it undergoes a correction,” he remarked, highlighting the robustness of the present momentum.

Other analysts, such as those at Skew, argue that the recent price surge was primarily fueled by media coverage rather than underlying economic factors. They point specifically to reports about upcoming US-UK trade deals and speculations regarding President Trump’s tariff policies.

He states this turns into a “vital trading day,” with volumes and passive inflows deciding if Bitcoin manages to maintain its position above $100,000 or retreats due to mounting pressures.

At present, the technical indicators remain favorable. BTC/USD has recently surpassed an important Fibonacci level of 1.618 and is currently trading close to a significant volume-area high (VAH), as noted by analyst Patric H.

BTC/USD perpetual futures 1-day chart. Source: Patric H.

Continuing with this effort might eliminate the last bit of opposition before reaching unprecedented peaks.

Backing that theory, Bitcoin

liquidation data

On CoinGlass, it appears that sellers are becoming less prevalent above $103K, potentially providing Bitcoin with the room required for a clear upward surge.

Stepping back, certain experts are already focusing their attention well past the $100K mark.

Pseudonymous analyst Egrag Crypto has placed a long-term target around $170,000 if BTC can pull off a clean break and close above $109K.

Nevertheless, he cautions, anything less than that might simply turn out to be another bull trap.

Changpeng Zhao, the founder of Binance, also joined Egrag. He predicted a potential peak value ranging from $500,000 to $1 million, attributing this surge to substantial inflows from institutions, high-level governmental purchases, and what he refers to as a “crypto-friendly U.S. administration.”

Altcoin market recap

The alternative coin market surged by almost 15% in the last week, reaching a total value of $1.28 trillion by Friday.

Although increased risk tolerance was significant, rising speculations about the onset of alternative season also contributed to the spike.

The market share of Bitcoin has been increasing gradually, with several experts monitoring it carefully for possible changes.

Traditionally, when Bitcoin reaches a 71% market share, it often begins to consolidate, which typically provides alternative cryptocurrencies with an opportunity to gain momentum.

Currently, Bitcoin’s dominance is at approximately 64%, which sets the scene for a potential significant retest, as pointed out by Rekt Capital.

As altcoins experience a significant resurgence, the Altcoin Season Index has surged from 18 last week to 37, indicating an early signal of growing risk tolerance within the marketplace.

The top performers were:

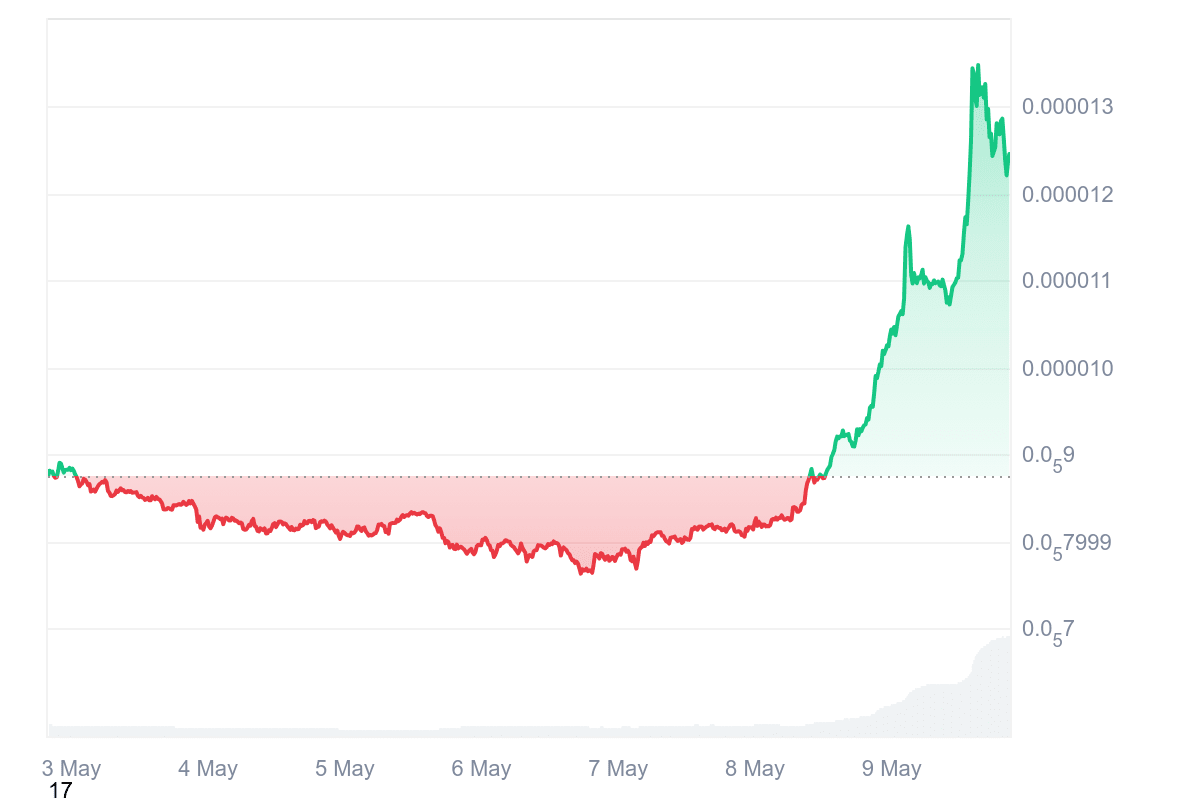

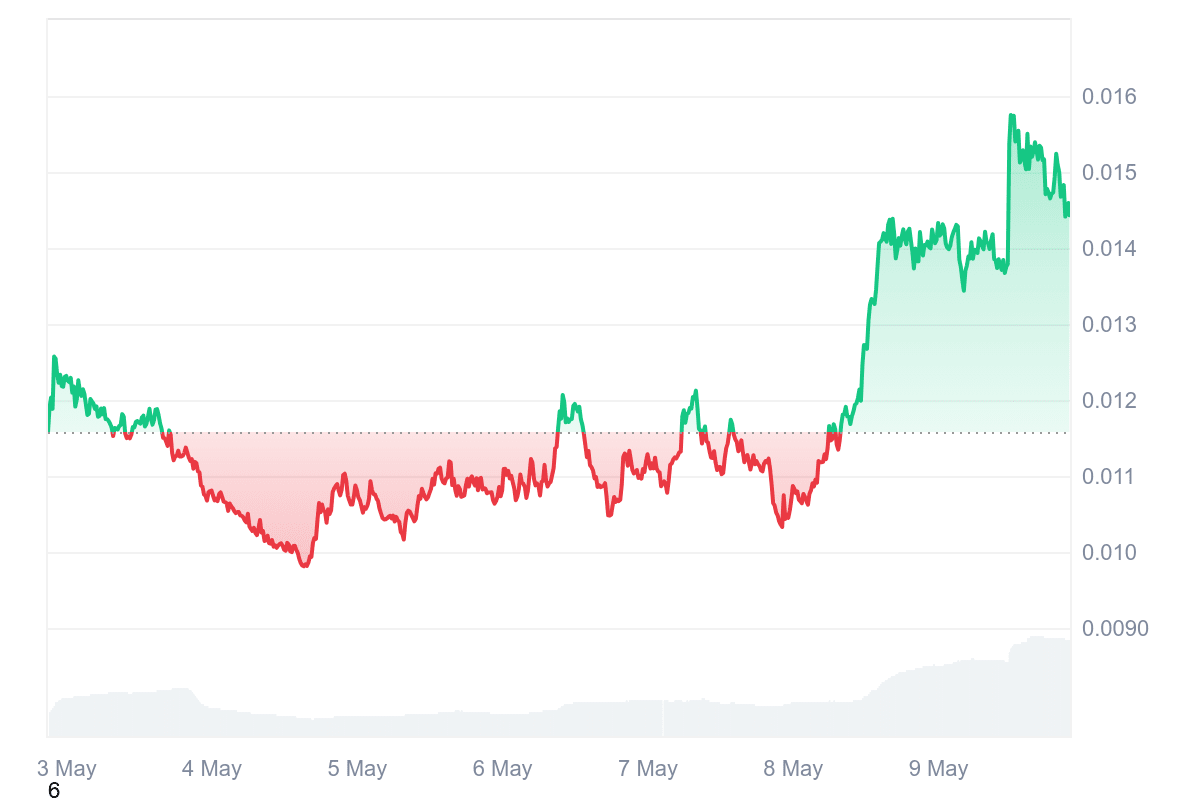

Pepe

Pepe (PEPE) surged by 41.3% over the last seven days and was being traded at $0.00012 when this was written.

This surge boosted its market capitalization to $5.24 billion, marking its peak value since February.

Source:

CoinMarketCap

The majority of the increases occurred following Elon Musk’s post of an image featuring Pepe the Frog alongside the Pepe memecoin mascot adorned in American-themed armor, which reignited enthusiasm amongst investors.

Musk has previously influenced financial markets through his Twitter posts, particularly when it comes to promoting meme coins such as Dogecoin (DOGE) and Pepe.

PEPE received an additional uplift following the formation of a “double-bottom” pattern on the charts, which is considered a bullish indicator in technical analysis suggesting potential further increases in value over the next few weeks.

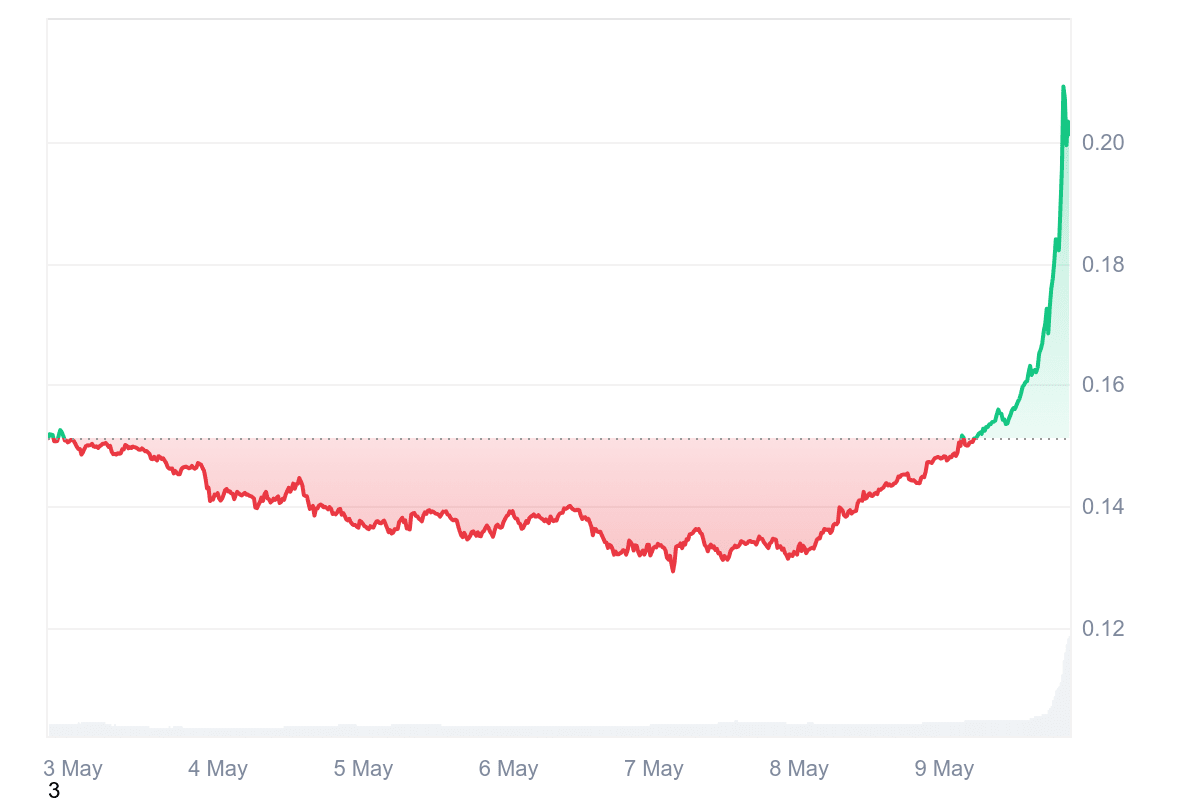

Pyth Network

In the last seven days, Pyth Network (PYTH) has surged approximately 33%, reaching roughly $0.20 as this is written, which has raised its market capitalization above $730 million.

The daily trading volume skyrocketed too, increasing by about 600% as of May 9th, remaining just over $225 million.

Source:

CoinMarketCap

The majority of these improvements occurred following Jupiter Exchange’s announcement that they had incorporated Pyth’s Express Relay into Juno, their recently launched liquidity system.

This integration enables traders to obtain the optimal price by accessing Pyth’s live data streams.

Additionally, further excitement among investors appears to stem from the potential that Pyth might incentivize community members who made it onto the April Kaito leaderboard, possibly via a PYTH token distribution by the end of this week.

Pudgy Penguins

The Pudgy Penguins (PENGU) token surged by 21% within the last week, pushing its market capitalization above $4.9 billion as of this writing.

The daily trading volume saw an increase too, jumping 36% as approximately $540 million worth of tokens were traded among participants.

Source:

CoinMarketCap

The primary driver behind most of its increases was its listing on Upbit, one of South Korea’s leading cryptocurrency exchanges, where PENGU was introduced for spot trading.

In addition, the sales of Pudgy Penguins’ NFTs have been skyrocketing recently.

According to data from Crypto Slam, there was a surge of 140% in sales over the last 24 hours, generating $680,000, which positioned Pudgy Penguins as the seventh most popular NFT collection globally.

The post

Bitcoin recovers $100K mark as experts anticipate fresh all-time high; PEPE, PYTH spearhead weekly gains.

appeared first on