Key points:

Bitcoin (

BTC

They maintained significant profits until the weekly close on May 11, as analysts identified this crucial level to watch moving forward.

Analysis: The BTC price has the potential to “initiate the breakout process”

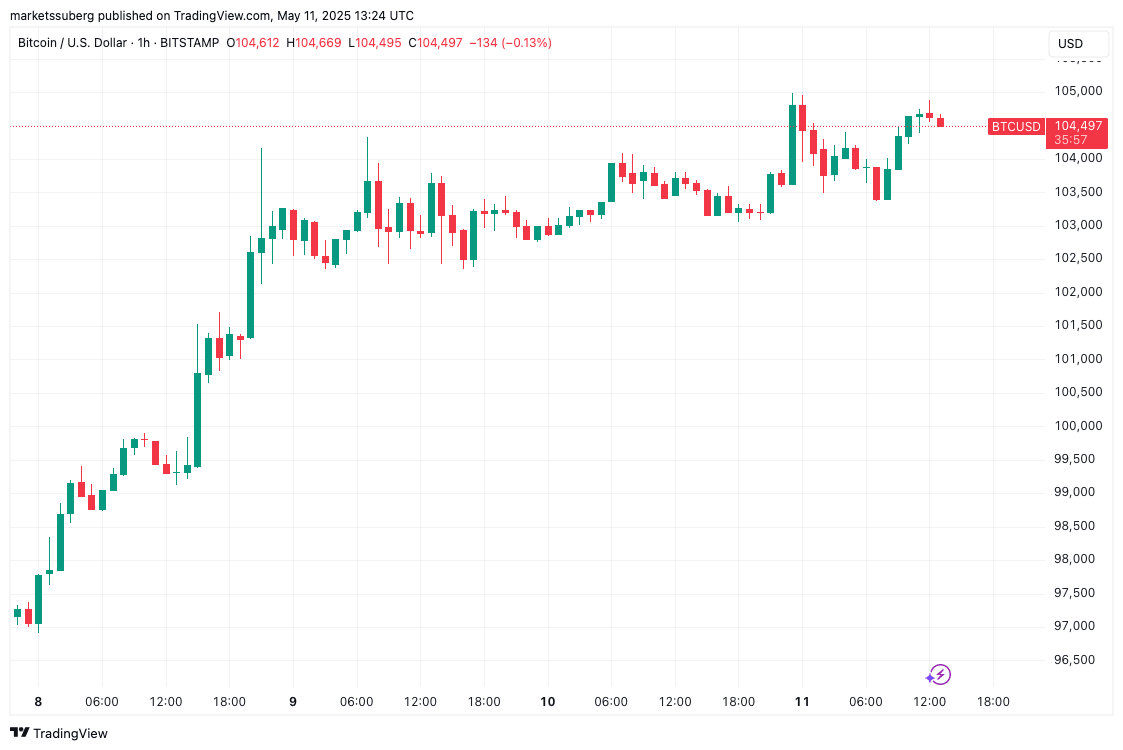

Data from

Cointelegraph Markets Pro

and

TradingView

demonstrated weekend upside volatility, reaching new multimonth peaks of almost $105,000.

The absence of sufficient liquidity during after-hours trading was a contributing factor to the shift, which again occurred behind the scenes.

positive rumors

regarding a US-China trade agreement.

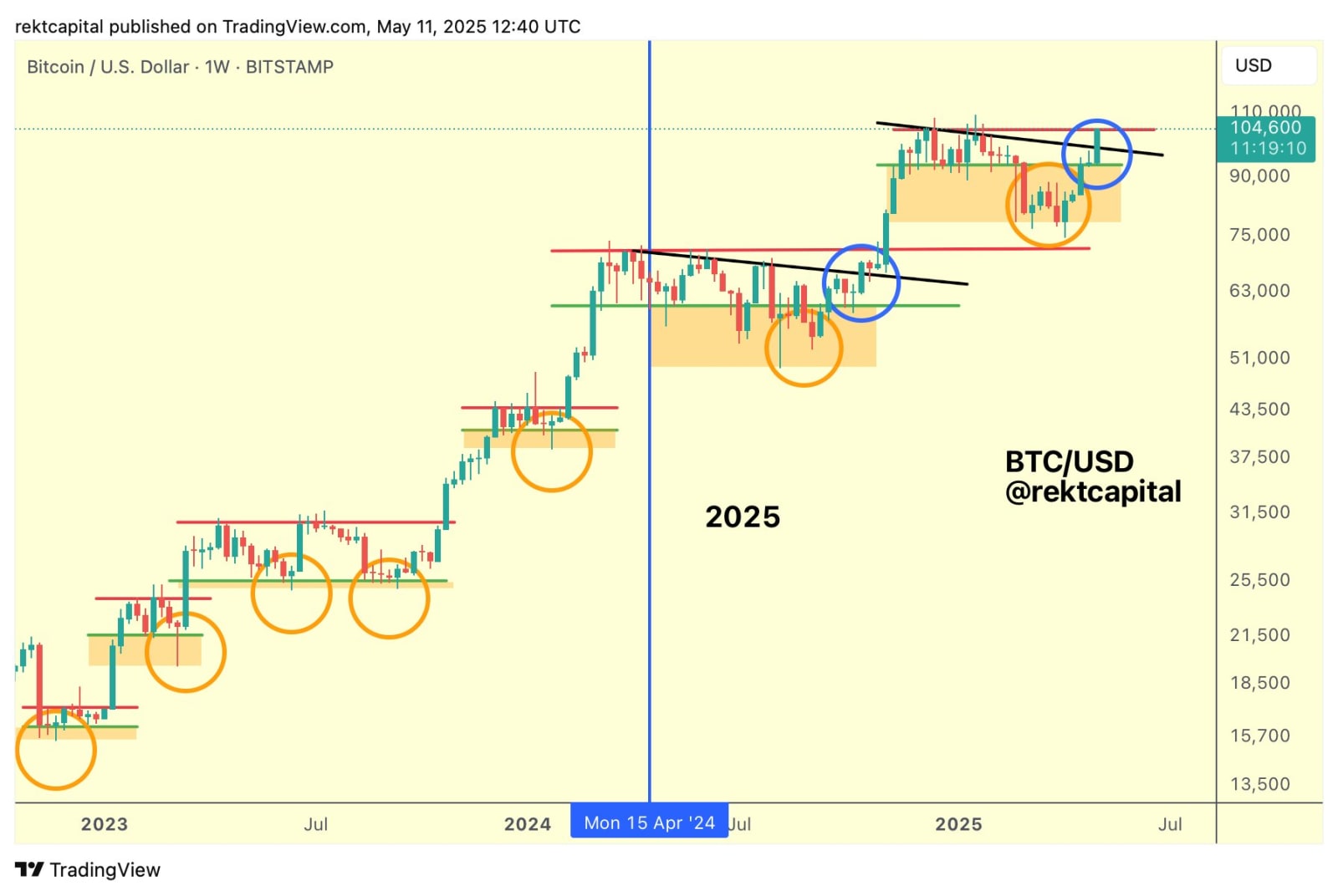

Currently, the well-known trader and analyst Rekt Capital has indicated that Bitcoin might trigger a resurgence leading back to its all-time high prices and renewed pricing exploration.

He mentioned that the crucial weekly pivot point to turn into support was around $104,500.

“Is Bitcoin capable of closing above the upper range limit of its newly regained re-accumulation zone for initiating a breakout?” he asked in a

post on X

alongside an explanatory chart.

“Bitcoin is on the cusp of beginning Price Discovery Uptrend 2.”

An additional update calculated the current Bitcoin bull market as 85.5% complete, yet with the most erratic upswings still to come.

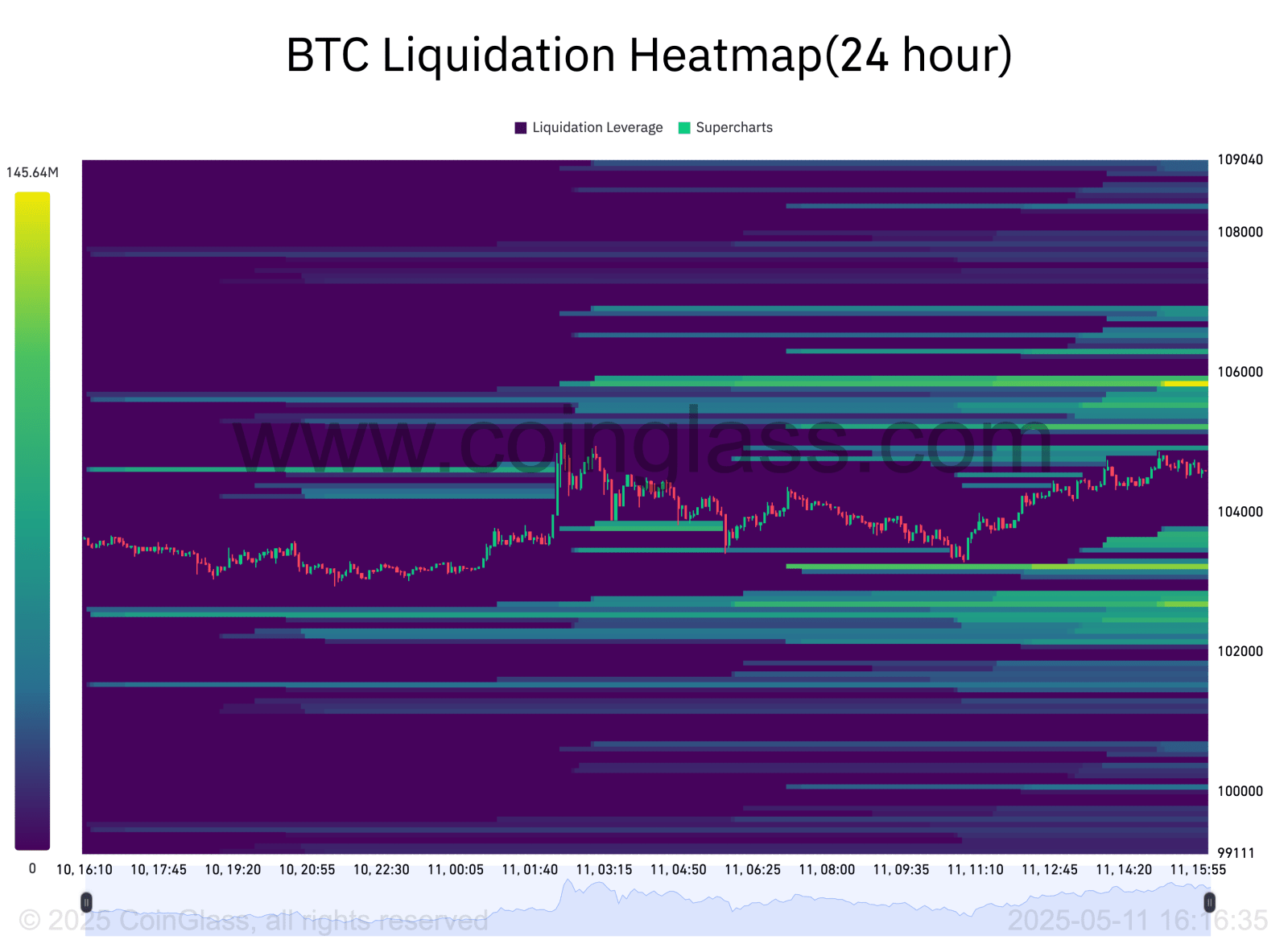

A look at the latest exchange order book data from monitoring resource

CoinGlass

displayed a substantial cluster of ask orders gathered around the region just beneath $106,000 when this was written.

The bids were gradually reduced to $102,000, forming an increasingly dense layer of liquidity near the current market price as the week came to a close.

Bitcoin could potentially retrace “the whole movement”

Certain market players continued to be pessimistic about short-term horizons.

Related:

Is Bitcoin poised for explosive growth? Price projections point to a potential target of $160K.

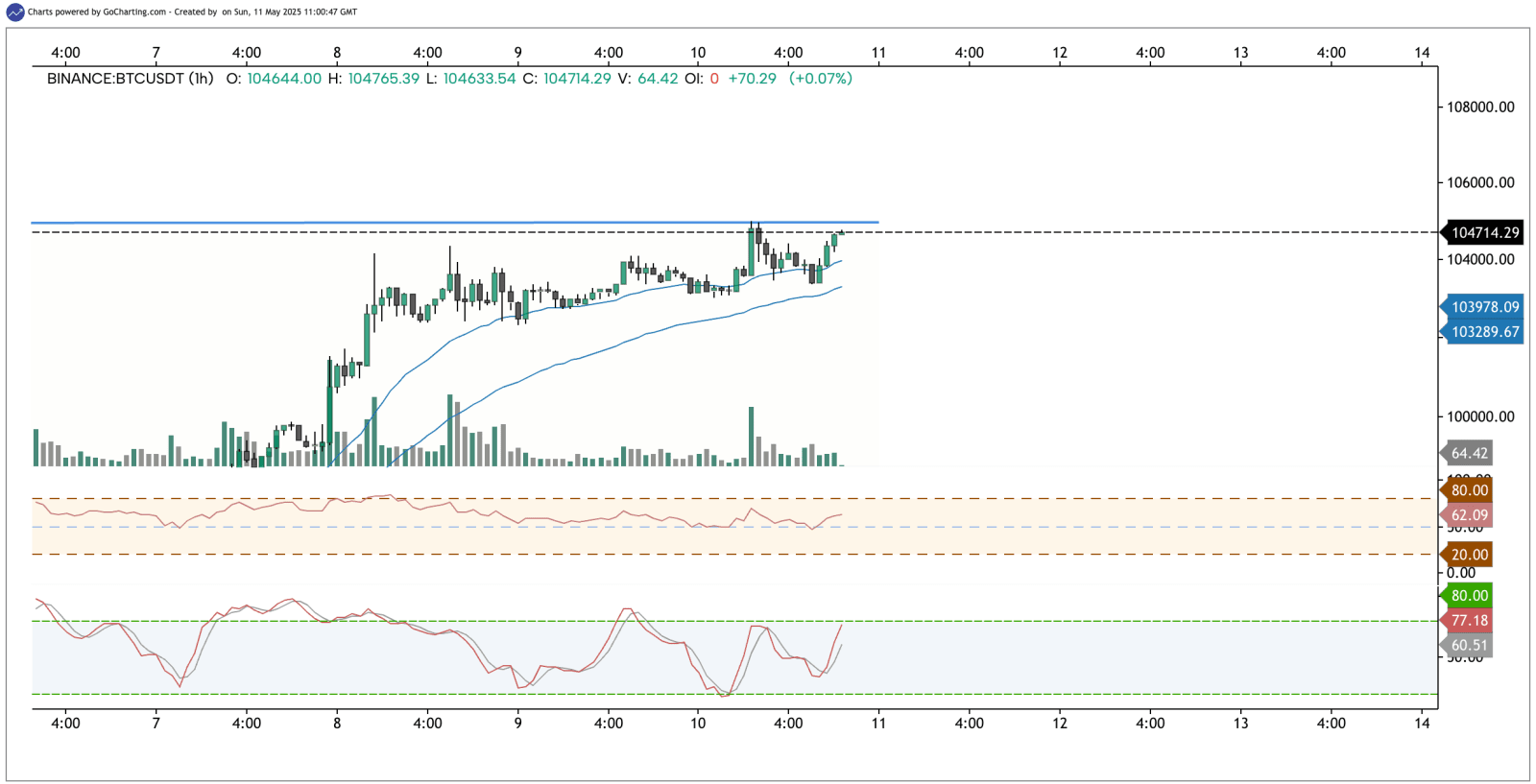

On this day, prominent trader HTL-NL contended that the recent surge towards record levels would ultimately turn out to be a “deception” designed to ensnare investors who entered positions too late.

“Will $BTC finish/start the coming week inside the current range, will it perform a ‘false breakout (UTAD),’ or is this truly just an accumulation zone as some hope?” he asked.

wrote

on the day.

To tell you the truth, even though I still prefer the initial two choices according to the M/Q graphs, the idea of it being reaccumulation isn’t out of the question.

Yet another warning, commonly heard in Bitcoin trading circles, was issued by fellow trader Il Capo of Crypto.

In his

latest X updates

The anonymous commenter cautioned that BTC/USD might decline to the point where its full recovery is negated.

“This is the moment to expand outward, rather than contracting,” he contended on May 10.

Significant obstacles are currently being encountered, and should this be merely a retracement within the downward trend that started in January, the whole movement might ultimately reverse itself.

Il Capo of Crypto

originally gained notoriety

For his $12,000BTC price predictions at the beginning of the bullish market in 2023.

The content of this article neither offers nor implies financial advice or suggestions regarding investments. Any decisions involving money and trade carry risks, thus viewers should perform independent investigations before reaching conclusions.