Key Takeaways:

The crypto market indicates potential for an altseason, during which altcoins will likely see much stronger performance compared to Bitcoin.

(BTC)

It could be on the horizon. Technical analysis and investor sentiment indicate that May 2025 may initiate a wider rally for alternative coins, fueled by crucial metrics and changing investment patterns.

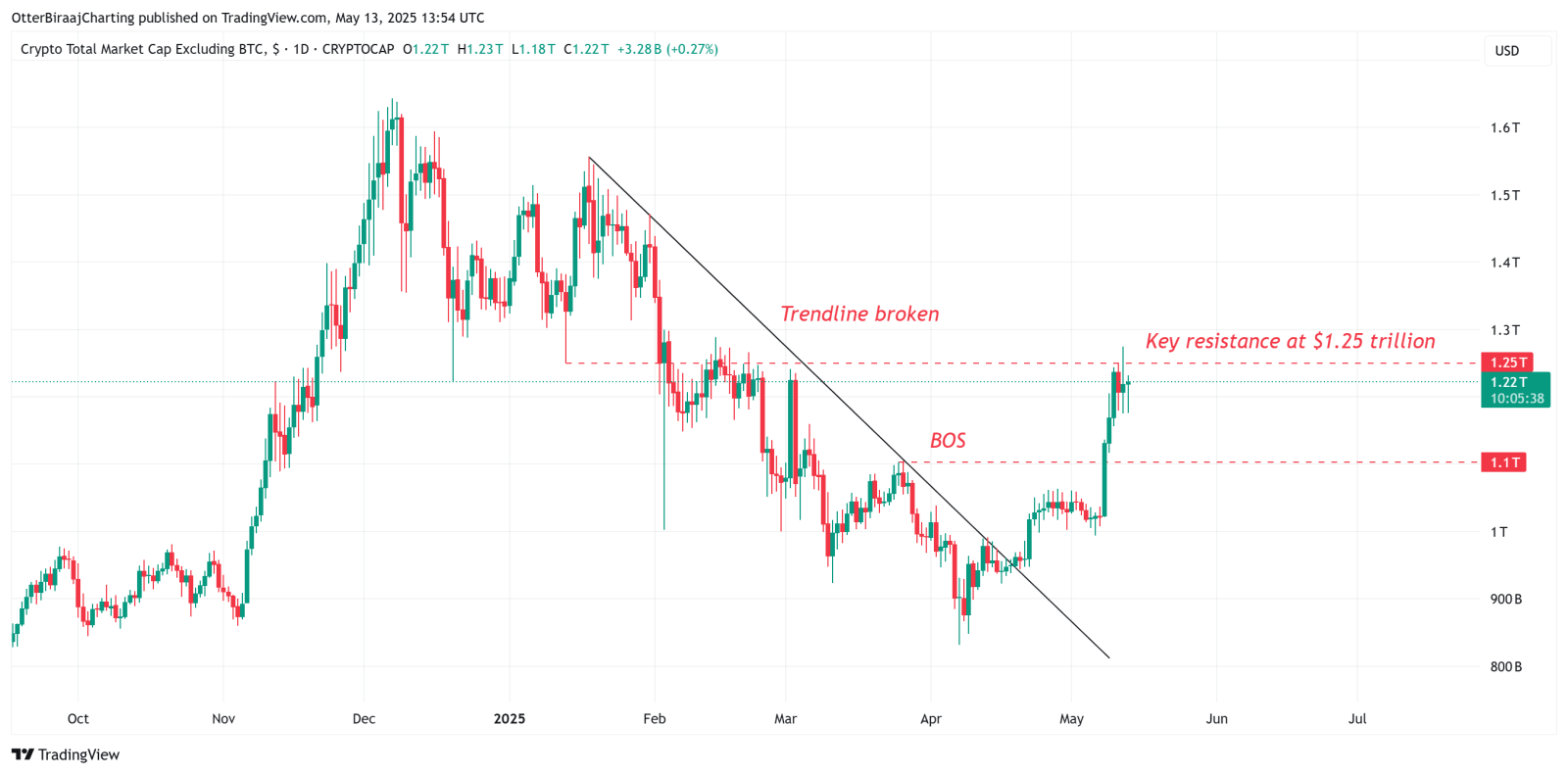

The TOTAL2 index, which reflects the aggregate market cap of all cryptocurrencies apart from Bitcoin, has surged past an ongoing downward trendline since January 2025. This upward breakthrough is supported by a bullish break of structure (BOS) evident on the daily charts, with formations showing higher-lows being established.

An assertive breakthrough past the $1.25 trillion resistance threshold might foster an unequivocal upsurge characterized by increasing troughs and peaks. Such a transition indicates a reallocation of funds from Bitcoin to alternative cryptocurrencies.

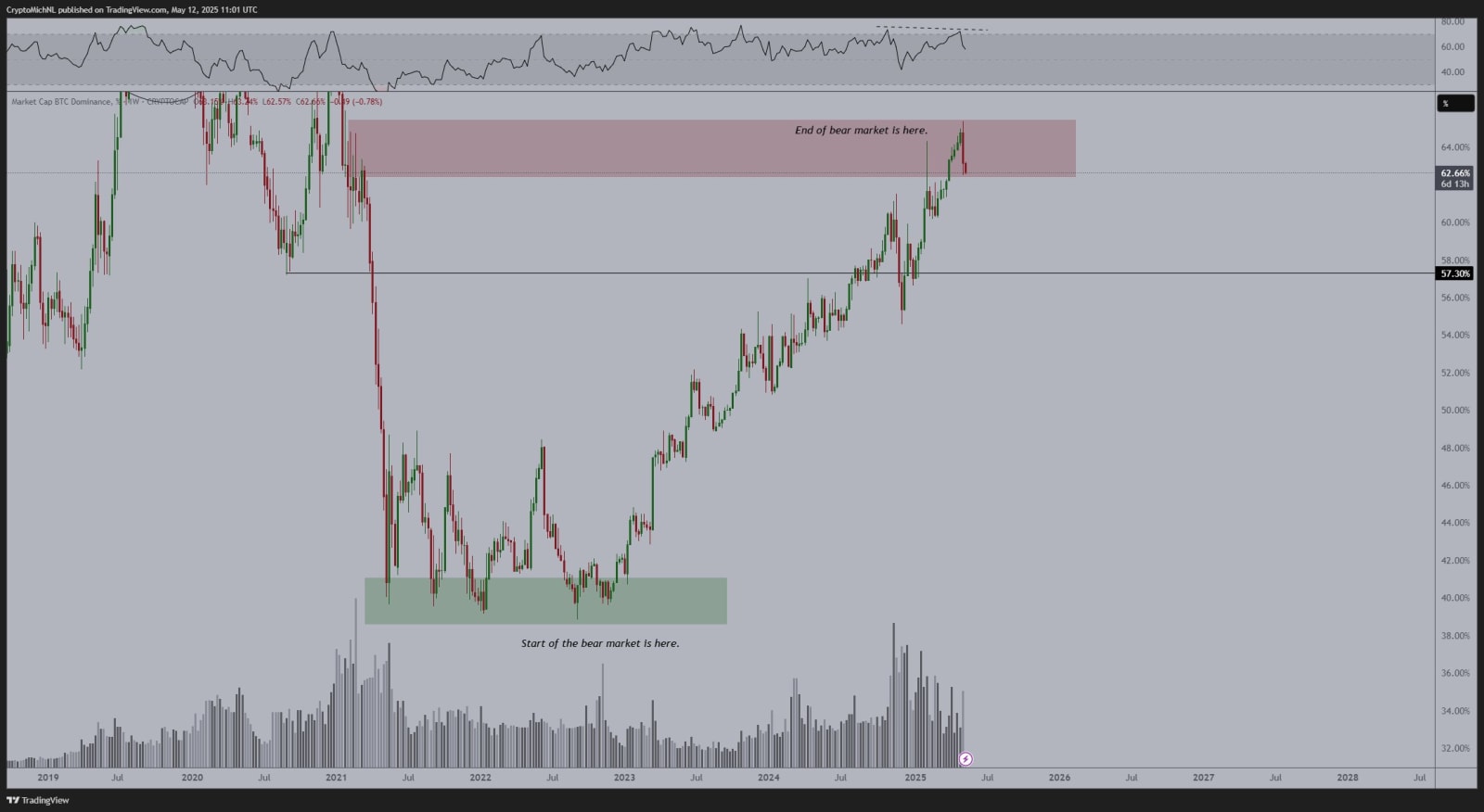

Likewise, the Bitcoin Dominance (BTC.D) chart suggests a possible market top, as it has decreased by 4% in the last six days —the most substantial decline since November 2024. When the BTC.D drops, this usually means funds are moving away from Bitcoin into alternative cryptocurrencies, allowing altcoins to capture more of the market and potentially fueling overall price increases.

Michael Van Poppe, who founded MN Capital, pointed out this tendency, observing a bearish divergence occurring alongside diminishing trading volumes. The analyst

said,

Significant bearish divergence observed on the weekly chart suggests that Bitcoin’s dominance may have reached its peak. This could mark the conclusion of the bear market phase for altcoins.

Related: History repeats itself? The XRP price surged by 400% when whale flows reversed last time.

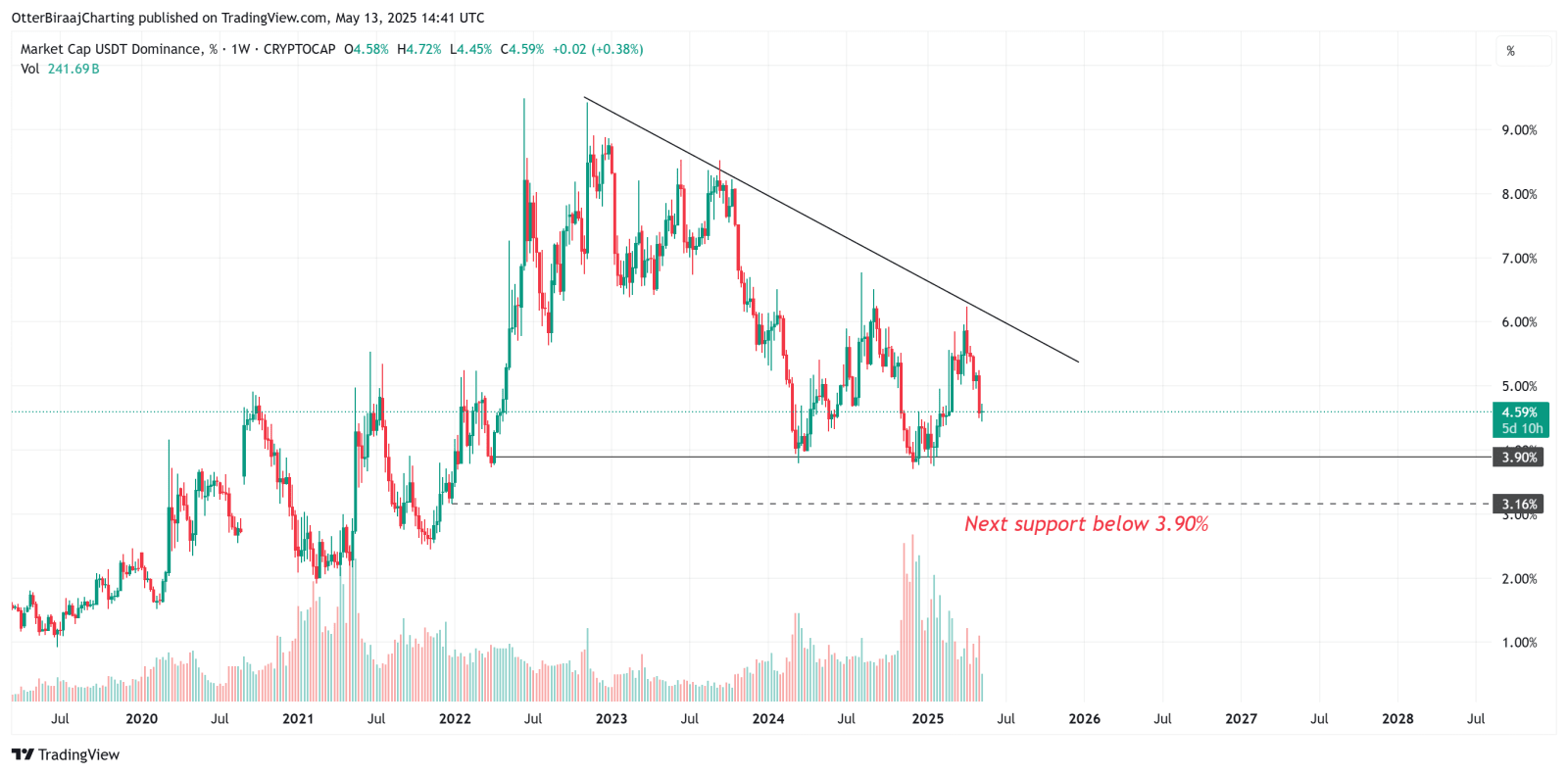

The share of USDT might fall to record-breaking levels.

The tether (

USDT

The dominance chart for this asset has fallen to its lowest point since early February, reaching 4.59% on May 13. As shown below, the USDT.D chart might find support around 3.90%, displaying a descending triangle formation. If there’s a bearish breakout from this pattern, it could result in new lows not seen since 2021, aligning with past altseason levels.

The decline in USDT dominance suggests that capital is being redistributed into other assets such as Bitcoin and altcoins. In the last seven days, we’ve seen this shift with Ethereum.

(ETH)

, XRP

(XRP)

and Solana

(SOL)

have gained 44.3%, 20.6% and 22% respectively, compared to BTC’s 10% rise.

Enhancing the analysis further during the recovery phase, crypto trader ZERO IKA

observed

Many altcoins have established a breakout above their structures from the high points observed in February and March.

The analyst pointed out that even with recent gains, many altcoins still sit at 70% to 90% below their peak values, suggesting this could be an opportune moment relatively early in the potential rebound phase.

The weakening stablecoin and Bitcoin dominance, coupled with a rise in altcoin market cap, opens the door for an altseason, as long as the above key trends remain intact.

Connected: Dogecoin investors forecast a potential 180% surge in DOGE prices should Bitcoin’s upward trajectory persist

The content of this article neither offers nor implies financial advice or suggestions regarding investments. Any decisions related to buying or selling securities carries risks, and potential investors are encouraged to perform independent investigations before proceeding.