Cryptocurrency investments in AI agent frameworks have surpassed all other subcategories over the last month. In contrast, other AI-associated token categories underperformed, even with the broader market rebounding.

In the last month, the leading story in cryptocurrency has been AI agent frameworks. These digital currencies embody both the principles of Web3 technology and the excitement around AI agent tokens.

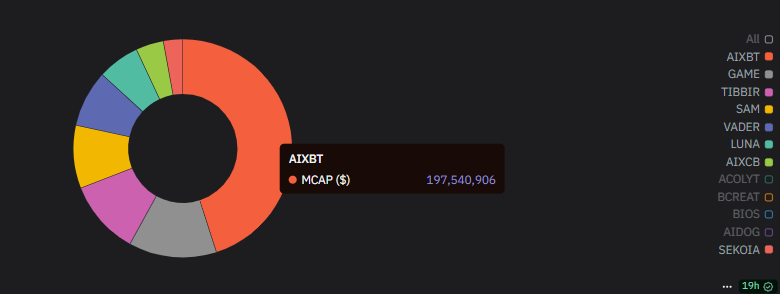

Based on Messari

data

In just one month, AI agents have grown by more than 186.3%, surpassing typical utility-focused initiatives. These AI-driven platform solutions hold promise for speculative trades. Meanwhile, areas like pure artificial intelligence, foundational infrastructure, computational capabilities, and DeFAI tokens show slower increases, aligning with broader trends of altcoin resurgence.

Launchpad tokens have a value of

$4.3B

, and are still a potentially growing sector. After peaking in late 2024, the AI narrative was almost forgotten. Currently, the sector is recovering, drawing attention back to launchpads and already existing AI agents.

By contrast, DeFAI tokens are only valued at $1.32B, which also includes some of the agent tokens. Older AI tokens, promising infrastructure or computation, are valued at over $39.1B, but react more slowly. Some of the categories overlap, but overall, growth is more active for the later wave of AI projects.

AI agent tokens are drawing new inflows

In addition to having utility, AI agent frameworks offer the potential for trading and social media attention, especially for the most successful AI agents. According to Alphanomics, existing agents are already logging more active fund inflows.

Frameworks also provide a platform and ecosystem for attracting investments. A prominent incubator that generated several high-impact tokens is the Virtuals Protocol (VIRTUAL). The activity on this protocol has reached levels last observed in February, although it remains significantly below the peak fee generation recorded in November and December 2024.

The top agents AIXBT and AI16Z exhibited the most significant recoveries amongst analysis-oriented AI personas, alongside Freysa and AVA.

The overall agent recovery drove VIRTUAL close to a three-month high, trading at $1.96. The token has been in accumulation for months and was closely watched for signs of a breakout. AI agent frameworks and individual tokens remain the most volatile asset type, and are also capable of quickly erasing their gains.

VIRTUAL has yet to reach its previous high of over $4.60, but currently, it is seeing unprecedented trading volumes. Centralized exchanges have witnessed activity surpassing $970 million. In recent days, VIRTUAL has been one of the most traded tokens on decentralized exchanges (DEX).

Despite the near cessation of new AI agent launches, the platform is experiencing a resurgence in popularity. Currently, well-established agents are attracting another surge of investment, rebounding from the low points observed in February and March.

Following the recent surge in altcoins, exposure to the AI story has gained momentum. The altcoin season index climbed to 35 points, prompting investors to look for fresh opportunities with breakout potential. Although AI-related assets haven’t reached their former peak levels, they’ve demonstrated the capacity to rebound by over 100% from their lowest points.

Academy: Fed up with fluctuating markets? Discover how DeFi can assist you in generating consistent passive income.

Register Now